While the federal housing finance apparatus has weathered countless storms since the 2008 financial crisis—from subprime mortgages to pandemic-era forbearance programs—few could have predicted that cryptocurrency would emerge as the next frontier in mortgage underwriting.

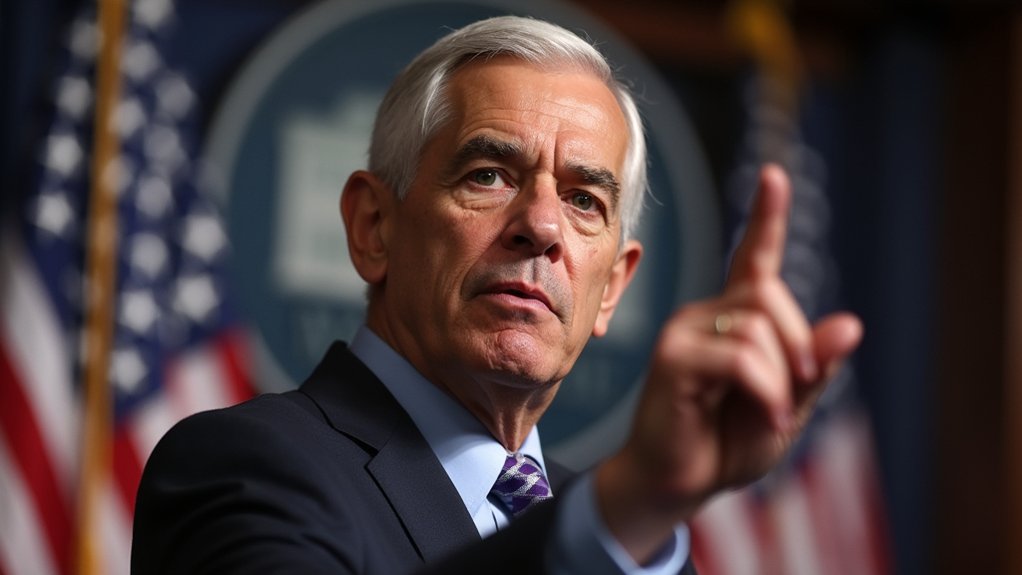

FHFA Director William J. Pulte has issued a directive requiring Fannie Mae and Freddie Mac to evaluate cryptocurrency as collateral for single-family mortgage loans, marking the first formal inclusion of digital assets in U.S. housing finance. The move ostensibly aligns with former President Trump’s vision to establish America as the crypto capital of the world—a goal that apparently now extends to suburbia’s picket fences.

The directive permits borrowers to leverage cryptocurrency holdings as reserve assets without liquidating them into cash, potentially expanding homeownership access for those whose wealth exists primarily in digital form. However, this modernization comes with stringent requirements: only crypto assets held at U.S.-regulated centralized exchanges qualify, and valuation adjustments must account for the notorious volatility that makes Bitcoin’s price swings resemble a seismograph during an earthquake.

The new policy opens homeownership doors for crypto millionaires while grappling with digital assets that fluctuate like geological tremors.

Fannie Mae and Freddie Mac—those government-sponsored enterprises that guarantee over half of all U.S. mortgages—must now submit proposals detailing how they’ll incorporate these digital assets into their risk models. The irony is palpable: institutions created to stabilize housing markets after a catastrophic financial crisis are now embracing assets known for their spectacular price volatility. Before implementation can proceed, these agencies must secure board approval for their cryptocurrency assessment frameworks.

Director Pulte’s disclosure of personal cryptocurrency connections within his household has prompted scrutiny about potential conflicts of interest, though such transparency seemingly exceeds typical regulatory standards. The timing raises questions about whether policy innovation or personal circumstance drives this unprecedented expansion of acceptable collateral.

The economic implications extend beyond individual borrowers. This directive could influence other lending sectors to incorporate digital assets, potentially stabilizing mortgage lending for crypto-wealthy borrowers while providing institutional validation for cryptocurrency’s role in traditional finance. The broader acceptance of digital assets is reflected in the growing stablecoin market, which has reached approximately $228-$251 billion in total market capitalization as of 2025. The Trump administration has further solidified its commitment to digital assets through an executive order establishing a Strategic Bitcoin Reserve and U.S. Digital Asset Stockpile.

Whether this represents prudent modernization or regulatory overreach remains to be seen, but one thing is certain: the mortgage industry’s risk assessment models are about to become considerably more complex, incorporating assets that didn’t exist when most of these frameworks were originally designed.