While most families might content themselves with traditional holiday gatherings around turkey and football, the Trumps have opted for a decidedly more ambitious seasonal pursuit: constructing what amounts to a crypto-financial empire that spans meme coins, stablecoins, and a planned $1.5 billion publicly traded treasury company.

World Liberty Financial, the family’s primary crypto venture, has already generated $550 million through WLFI token sales—a governance token that conveniently plans to become tradable on open markets. The company’s ambitious roadmap includes launching a publicly traded crypto treasury company via an already-acquired NASDAQ-listed shell firm, because apparently the traditional IPO process lacks sufficient theatrical flair for the Trump brand.

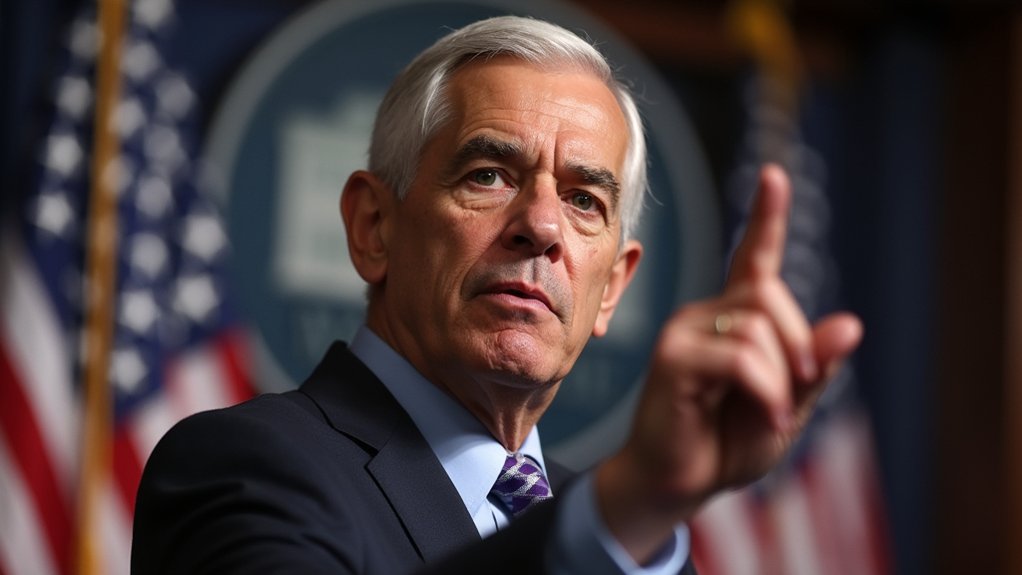

Eric Trump and Donald Trump Jr. are positioned to serve on the board of this planned public entity, while their father holds the rather Napoleonic title of “co-founder emeritus” on World Liberty’s website. The family’s crypto portfolio extends beyond mere governance tokens to include USD1, their dollar-backed stablecoin, and a forthcoming crypto-lending application that promises to leverage digital assets for financial services. The growing federal oversight of stablecoins through proposed legislation like the GENIUS Act could significantly impact how their USD1 operates, requiring full reserve backing and independent audits.

The timing proves fortuitous, coinciding with Trump’s 2025 executive order enabling 401(k) retirement plans to invest in cryptocurrency alongside private equity and real estate. This regulatory shift directs the SEC, Labor Department, and Treasury to update rules expanding access to alternative assets—a move that traditional investment firms view with cautious interest while emphasizing investor education regarding crypto’s inherent volatility.

Meanwhile, President Trump and Melania have launched separate meme coins tied to their personal brands, because nothing says “decentralized finance” quite like celebrity-endorsed digital assets. The family’s broader crypto involvement includes backing a Bitcoin mining company, demonstrating their commitment to the entire blockchain ecosystem. This approach mirrors MicroStrategy’s pioneering strategy from 2020, which accumulated over $72 billion in Bitcoin and achieved a market capitalization of nearly $113 billion.

Market skepticism persists, with some investors warning that crypto treasury firms might represent a transient fad prone to collapse. Yet World Liberty Financial continues pursuing major technology and crypto investors for their $1.5 billion fundraising goal, operating within a market where digital-asset treasury companies are targeting an estimated $79 billion in bitcoin purchases for 2025. The stablecoin sector faces significant hurdles including cybersecurity risks that threaten blockchain system integrity and potential liquidity crises during market stress periods.

Whether this represents visionary entrepreneurship or elaborate financial theater remains an open question.